We have over 100 years experience of protecting and maximising wealth for our clients

You've built a successful business and invested wisely over several decades. You've sought advice from accountants, solicitors, and financial advisors to minimize inheritance taxes and plan asset distribution in the event of serious illness or death. But have you safeguarded the operational value of your business?

Have a business continuity plan in case of serious illness or death

Separated the value of physical assets like buildings and the goodwill value of their business

Answer how personal guarantees would be paid if they were unable to operate their business

If their family would want to or COULD run their business

How to protect their income in case of serious illness or death

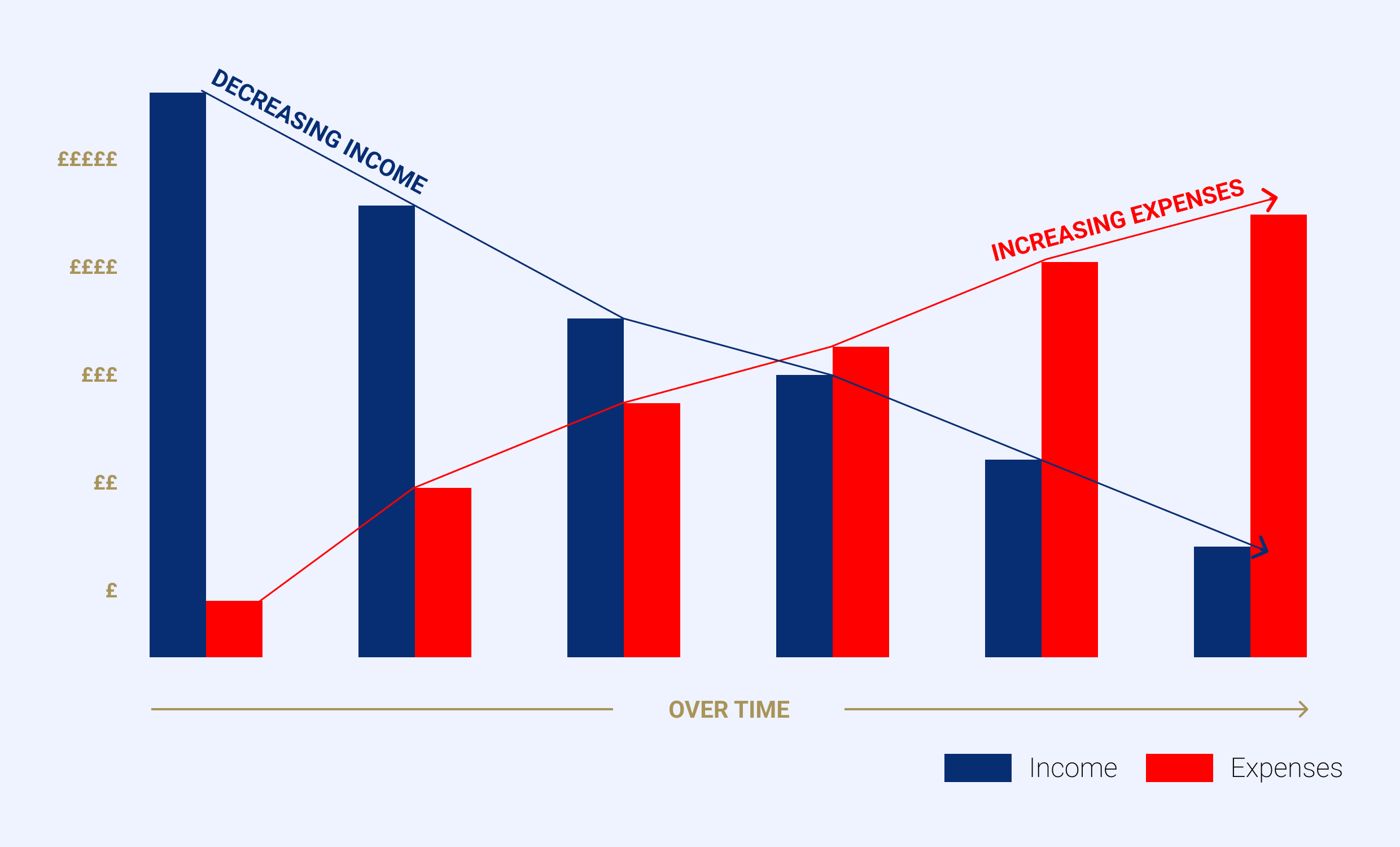

Income Requirement Increases | Capital value can fall Significantly

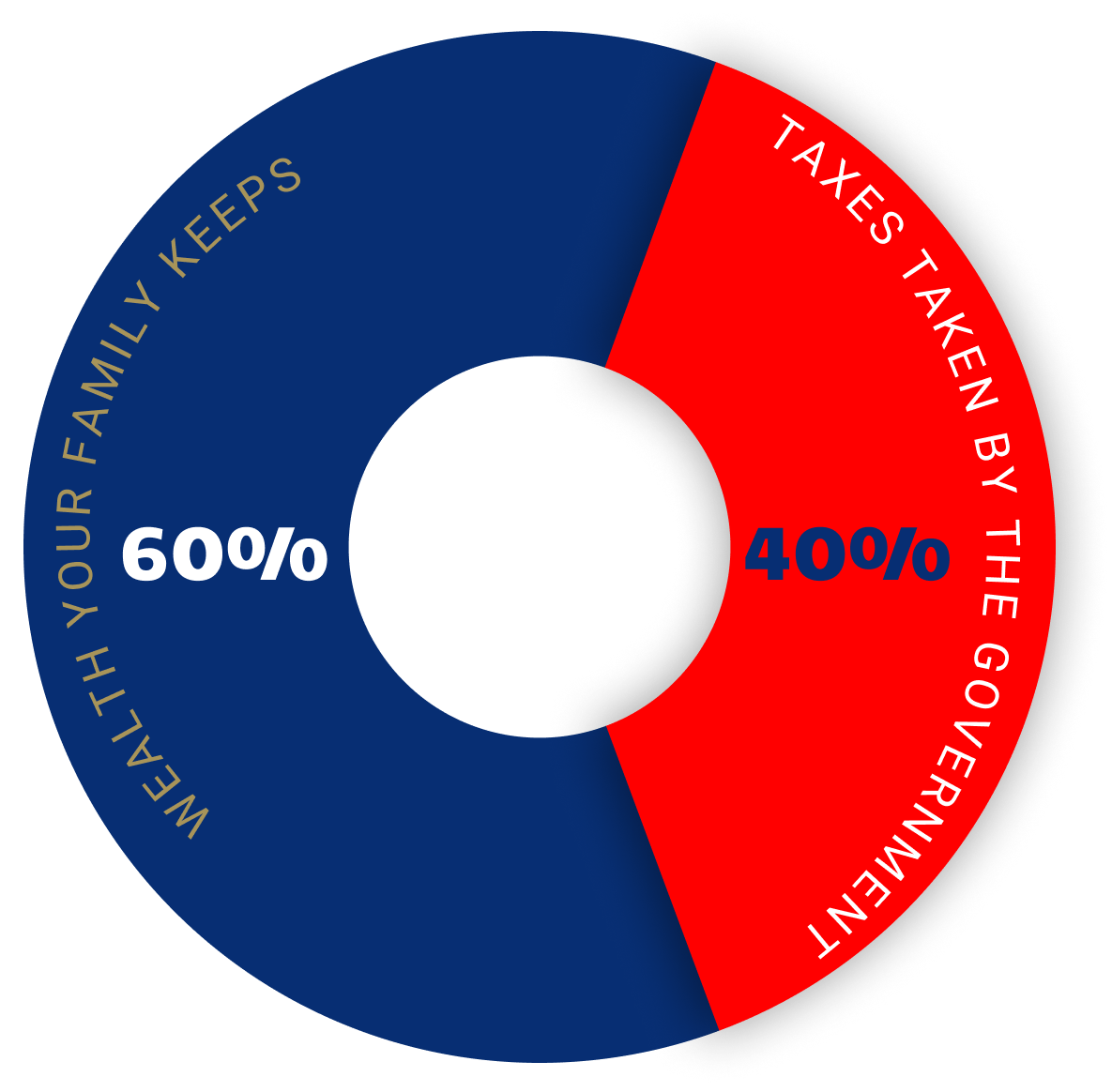

Protect Your Family

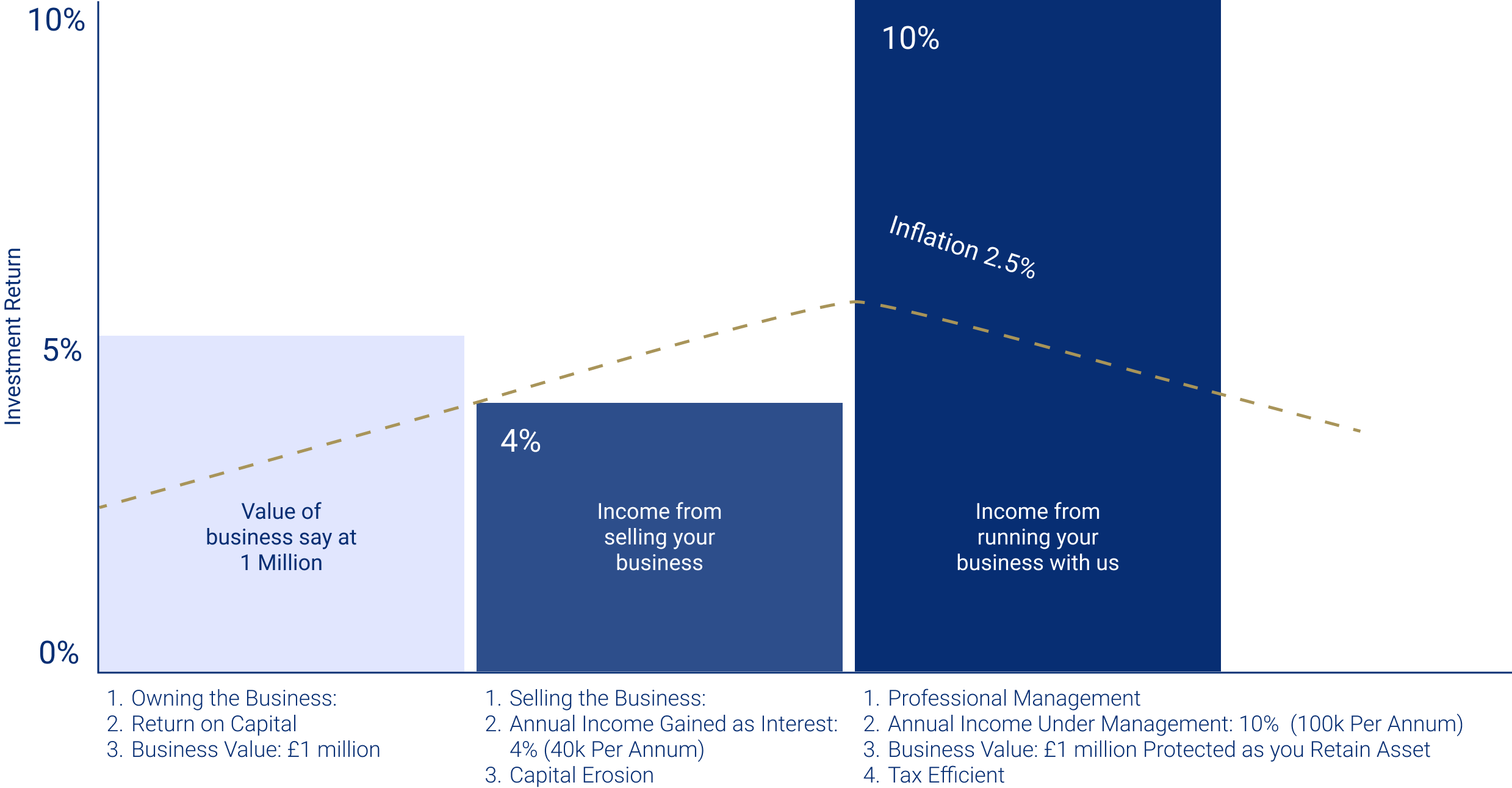

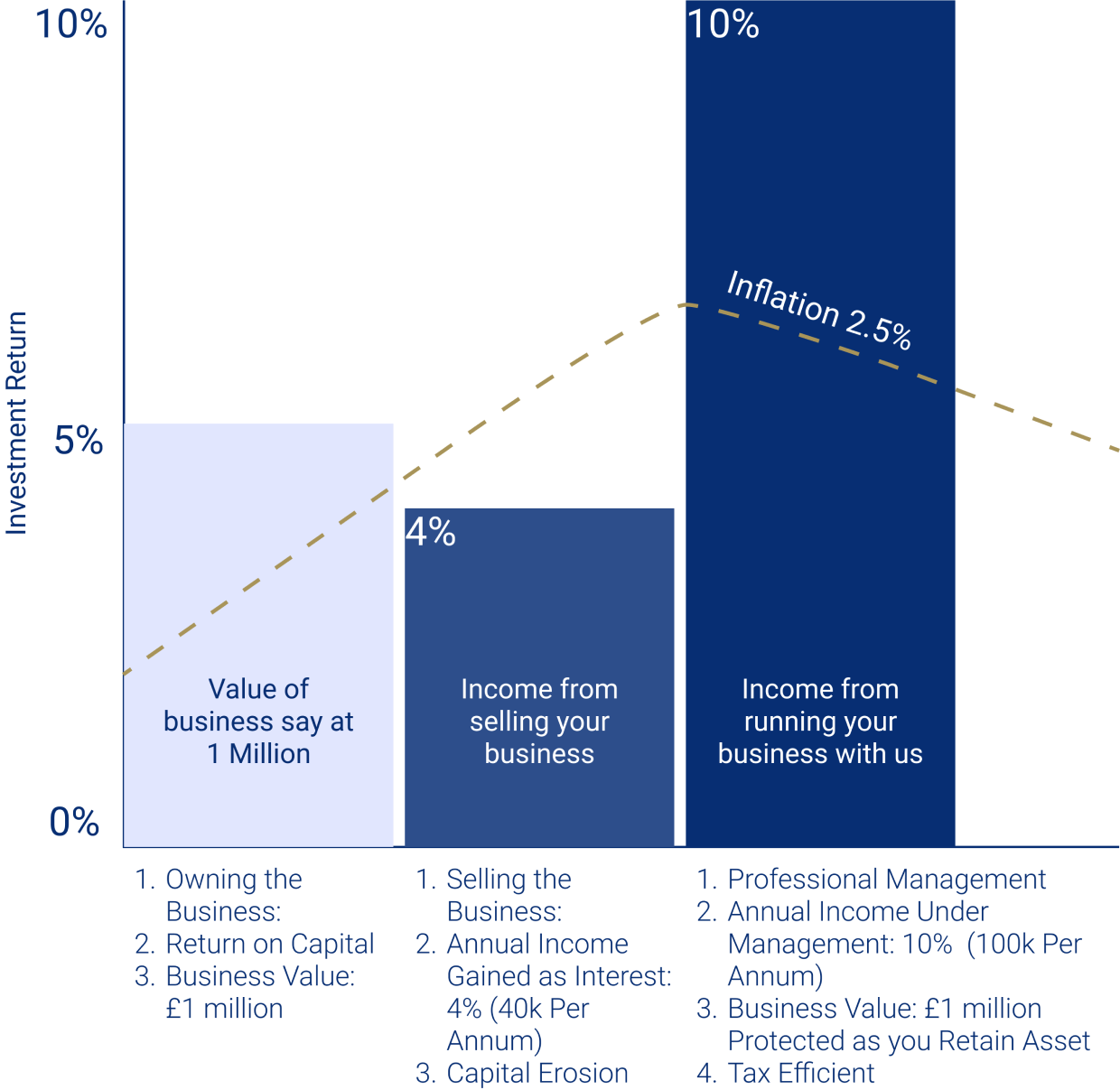

Maintain Business Value

Reduce Your Tax Liabilities

Safeguard Asset Value

Maximize Income & Capital Value

Unrivaled Experience, we are unique

We provide capital and professional advice

We only earn when we protect your wealth

Leisure & Hospitality

Manufacturing

Professional Services

Real Estate & Construction

Technology & Telecom

Farming & Food Processing

We were engaged by a regional owner of restaurants and pubs during an emergency period of ill health.

Private Wealth Trust , Lumaneri House, Blythe Gate, Blythe Valley Park, Solihull, B90 8AH

Private Wealth Trust © 2024. All Rights Reserved

Private Wealth Trust is a trading name of Private Wealth Protection Limited, company registration no. is 15878573